Asset Integrity Management Market Summary

As per Market Research Future analysis, The Global Asset Integrity Management Market was estimated at 25.8 USD Billion in 2024. The market is projected to grow from 27.4 USD Billion in 2025 to 50.01 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Asset Integrity Management Market is poised for substantial growth driven by technological advancements and increasing regulatory demands.

- Digital transformation is reshaping asset management practices, enhancing efficiency and data utilization.

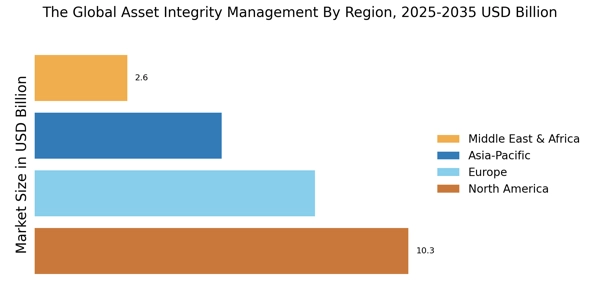

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in asset integrity management.

- Risk-based inspection (RBI) continues to dominate the market, whereas non-destructive testing (NDT) is witnessing rapid growth.

- Technological advancements and a rising focus on regulatory compliance are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 25.8 (USD Billion) |

| 2035 Market Size | 50.01 (USD Billion) |

| CAGR (2025 - 2035) | 6.2% |

Major Players

SGS (CH), Bureau Veritas (FR), Intertek (GB), DNV (NO), Applus+ (ES), TÜV Rheinland (DE), KBR (US), Aker Solutions (NO), Wood Group (GB), Fugro (NL), and Quest Integrity Group. These companies function as leading integrity management company providers delivering comprehensive asset integrity management services.